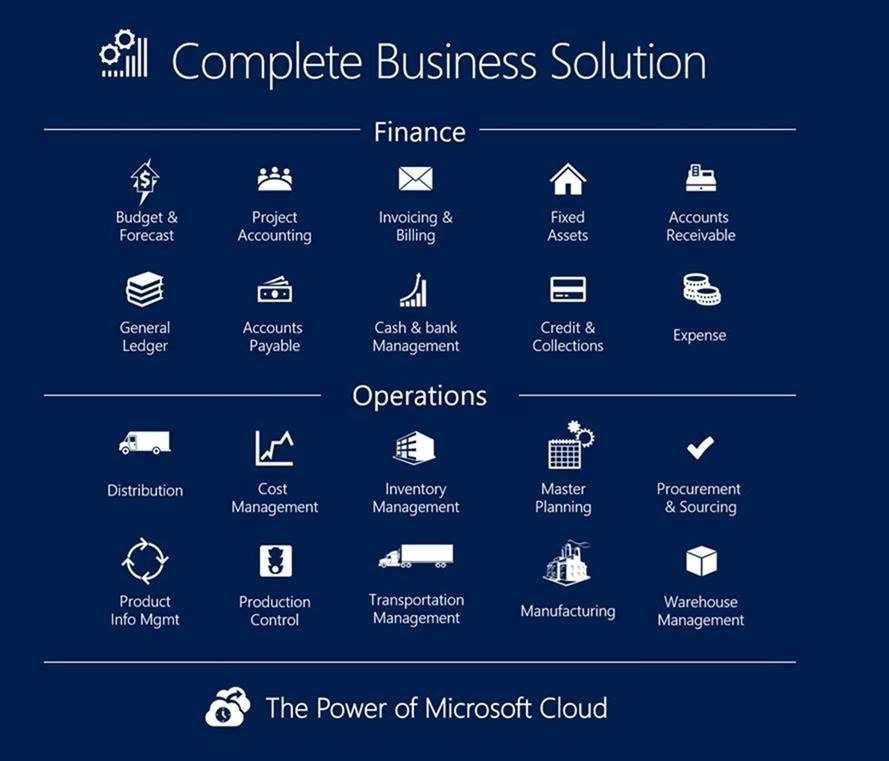

Microsoft Dynamics 365 for Finance and Operations

Financial Management

Confidently manage your firm’s finances through the use of a powerful global financial management platform that will help your organization grow and expand without boundaries.

- Leverage integrated accounting modules such as general ledger, banking, accounts payable, and AR & collections.

- Increase efficiency levels by integrating directly with your banks for electronic bank reconciliation, Positive Pay, AR Lockbox import, and EFT/ACH handling.

- Utilize an embedded budgeting and planning solution for managing your corporate budgeting and forecasting processes.

- Track the entire lifecycle of your fixed assets, from acquisition through retirement.

- Manage sales and use taxes, VAT, GST, and other global taxation requirements, including the ability to integrate to Vertex, Avalara, CCH, and other tax services.

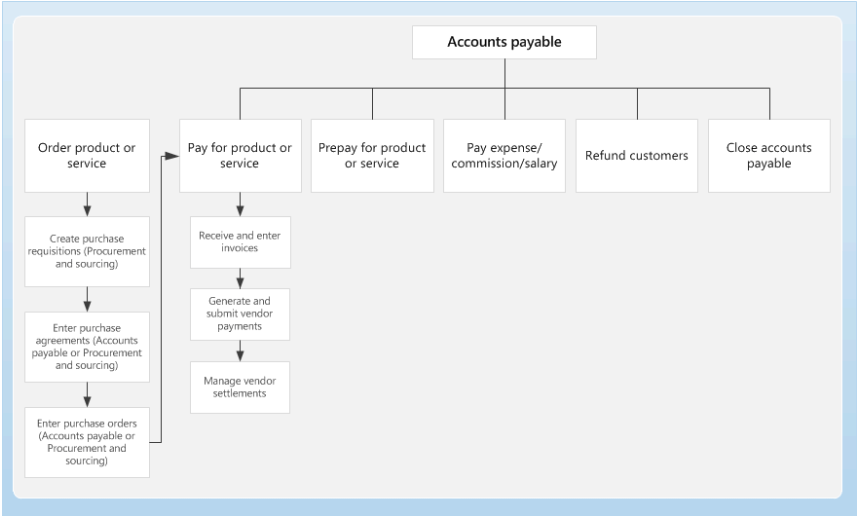

Account Payable

You can enter vendor invoices manually or receive them electronically through a data entity. After the invoices are entered or received, you can review and approve the invoices by using an invoice approval journal or the Vendor invoice page. You can use invoice matching, vendor invoice policies, and workflow to automate the review process so that invoices that meet certain criteria are automatically approved, and the remaining invoices are flagged for review by an authorized user.

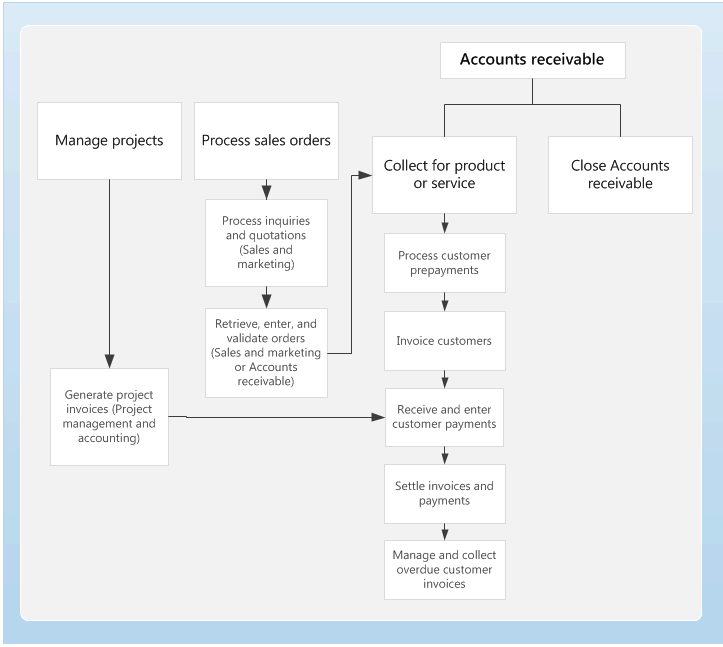

Accounts receivable

Use Accounts receivable to track customer invoices and incoming payments.

You can create customer invoices that are based on sales orders or packing slips. You can also enter free text invoices that are not related to sales orders. You can receive payments by using several different payment types. These include bills of exchange, cash, checks, credit cards, and electronic payments. If your organization includes multiple legal entities, you can use centralized payments to record payments in a single legal entity on behalf of the other legal entities.

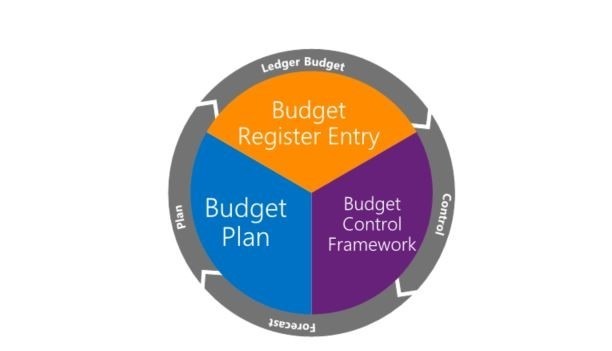

Budgeting

Components of budgeting functionality

The resource planning cycle for a company typically consists of planning, budgeting, and forecasting activities.

The processes for both long-term strategic planning and annual budget planning are supported through a budget plan document. Budget plan documents are tightly integrated with Microsoft Excel. Users can configure unlimited monetary and quantitative scenarios, and can also define a budgeting organizational hierarchy to both support top-down and bottom-up budgeting methods. After a budget is established and approved in Finance and Operations, you convert the budget plan to a budget register entry.

Budget register entries provide tools for maintaining the budget and for keeping amounts traceable through budget codes. Budget register entries let you revise original budgets, perform transfers, and carry forward budget amounts from the previous year. Based on the established budget, a company can enable budget control. The level of control depends on the organizational culture and the organization’s level of maturity.

Organizations that have low maturity might leave the budget “as is” and might be more reactive than proactive if a budget doesn’t meet expectations. Other organizations might enable budget control policies that prevent users from purchasing if budget funds aren’t available.

Finally, very mature organizations might establish an organizational culture where employees are educated about organizational targets and follow those targets through policies such as “Consider online meeting instead of a travel.” Finance and Operations includes a budget control framework that lets the company’s management select either hard control (which prevents postings that would go over the budget) or soft control (where users are warned that they will exceed the available budget funds but can decide for themselves how to proceed). Finally, you can use rolling forecasts.

A rolling forecast is a regular comparison of budget to actual and is used to define how well the company operates against the budget. A rolling forecast is also used to identify trends. In Finance and Operations, rolling forecasts are supported, through a budget plan document, as initial planning activities. Rolling forecasts can be done in parallel with the planning for the upcoming budget cycle.

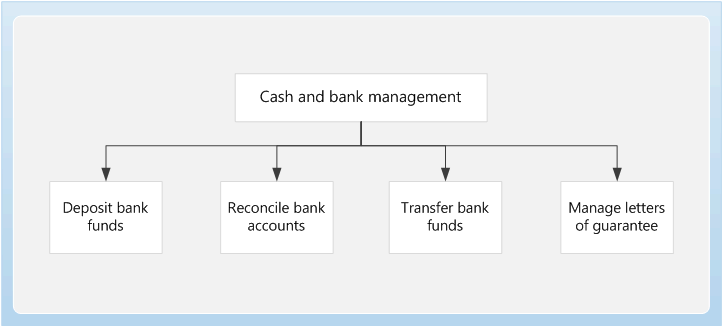

Cash and bank management

You can use Cash and bank management to maintain the legal entity’s bank accounts and the financial instruments that are associated with those bank accounts.

These instruments include deposit slips, checks, bills of exchange, and promissory notes. You can also reconcile bank statements and print bank data on standard reports.

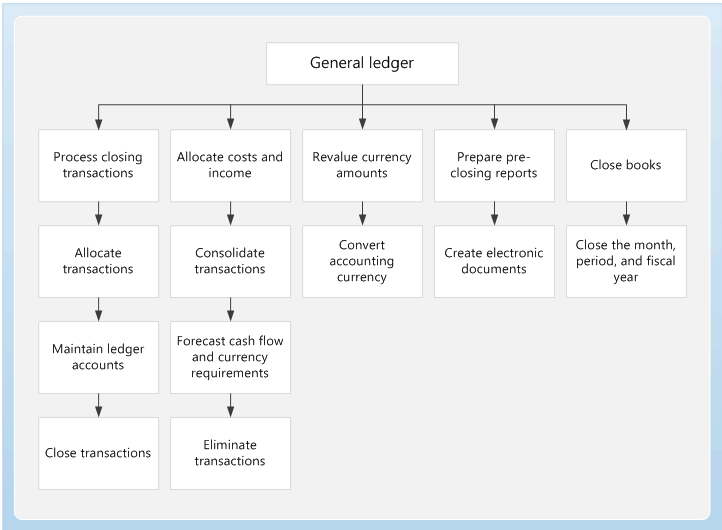

General ledger

Use General ledger to define and manage the legal entity’s financial records. The general ledger is a register of debit and credit entries. These entries are classified using the accounts that are listed in a chart of accounts.

- Plan your chart of accounts

- Main account types

You can allocate, or distribute, monetary amounts to one or more accounts or account and dimension combinations based on allocation rules. There are two types of allocations: fixed and variable. You can also settle transactions between ledger accounts and revalue currency amounts.

At the end of a fiscal year, you must generate closing transactions and prepare your accounts for the next fiscal year. You can use the consolidation functionality to combine the financial results for several subsidiary legal entities into results for a single, consolidated organization.

The subsidiaries can be in the same Microsoft Dynamics 365 for Finance and Operations database or in separate databases.

Sales tax

Every company collects and pays taxes to various tax authorities. The rules and rates vary by country/region, state, county, and city. In addition, the rules must be updated periodically when tax authorities change their requirements. Sales tax codes contain the basic information about how much you collect and pay to the authorities.

When you set up sales tax codes, you define the amounts or percentages that must be collected. You also define the various methods by which those amounts or percentages are applied to transaction amounts. The topics in this section provide information about how to set up sales tax codes for the methods and rates that your tax authorities require.

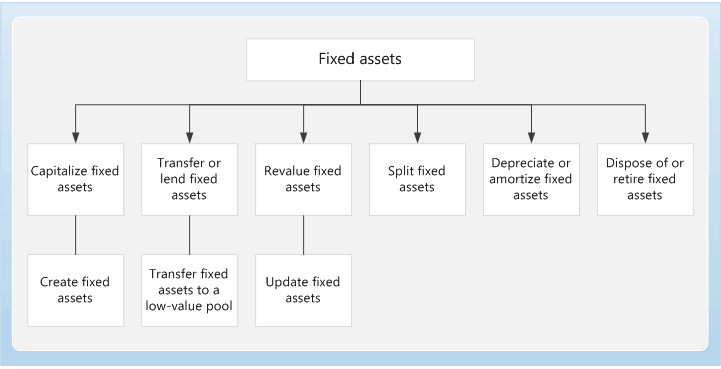

Fixed assets

Fixed assets are items of value, such as buildings, vehicles, land, and equipment, which are owned by an individual or organization.

You can set up and enter acquisition information for fixed assets, and then manage them by depreciating them and setting a capitalization threshold to determine depreciation. You can calculate adjustments to the fixed assets, and also dispose of them. When you use General ledger together with Fixed assets, you can view the current value of all fixed assets.

The way in which fixed assets are handled must correspond to both international accounting standards and the accounting legislation in each country/region. Requirements might include rules for recording acquisition and disposal transactions, depreciation, lifetimes, and write-ups and write-downs of fixed assets. The Fixed assets functionality incorporates many of these standards and rules.

Financial reporting

Financial reporting for Finance and Operations allows financial and business professionals to create, maintain, deploy, and view financial statements. It moves beyond traditional reporting constraints to help you efficiently design various types of reports.

Financial reporting includes dimension support. Therefore, account segments or dimensions are immediately available. No additional tools or configuration steps are required.

Default reports

Financial reporting provides 22 default financial reports. Every report uses the default main account categories in Finance and Operations. You can use these reports as is or as a starting point for your financial reporting needs. In addition to the traditional financial statements, such as Income statement and Balance sheet, these default reports include reports that show the different types of financial reports that you can create.

- 12 Month Rolling Single Column Income Statement – Default

- 12 Month Trend Income Statement – Default

- Actual vs Budget – Default

- Audit Details – Default

- Balance List – Default

- Balance Sheet – Default

- Balance Sheet and Income Statement Side by Side – Default

- Cash Flow – Default

- Detailed JE and TB Review – Default

- Detailed Trial Balance – Default

- Expenses Three Year Quarterly Trend – Default

- Financial Captions JE and TB Review – Default

- Income Statement – Default

- Ledger Transaction List – Default

- Ratios – Default

- Rolling 12 Month Expenses – Default

- Rolling Quarter Income Statement – Default

- Side by Side Balance Sheet – Default

- Summary Trial Balance – Default

- Summary Trial Balance Year Over Year – Default

- Weekly Sales and Discounts – Default

- Budget Funds Available – Default

Expense management

You can use Expense management to create an integrated workflow where you can store payment method information, import credit card transactions, and track the money that employees spend when they incur expenses for your business. You can also define expense policies and automate the reimbursement of travel expenses.

WhatsApp us

WhatsApp us

Leave A Comment