Chart of Accounts

The Chart of Accounts (COA) is the structured list of an organization’s general ledger accounts. These are referred to as main accounts in Dynamics 365 for Finance and Operations. COA is a “wrapper” for the list of main accounts to be used in a particular legal entity. Before you start creating the chart of accounts, it’s strongly suggested to do some planning.

Planning should be on Specification, Structure, External/Legal Requirements, Spacing and Numbering and Sharing.

To track and maintain financial information in an organization, you can set up a chart of accounts. A chart of accounts is a collection of GL accounts that define a financial framework.

The list is used to prepare financial reports for authorities and owners. The accounts are first grouped into types of accounts and then further aggregated into larger categories. At the most general level, the accounts are grouped as revenues and costs (operating accounts), and assets and liabilities (balance accounts).

To create the COA, users should list out the accounts that group well together and group kinds of assets, liabilities, revenues, costs, and balance accounts. The Contoso Demo data in D365 for Finance and Operations application has a pretty good starting point for our chart if we are not sure where to begin.

GL code in Chart of account is suggested be of 6 digit length as it will provide plenty of space for growth, It just feels right when you type it and It looks balanced when printed as Trial Balance.

We can reserve digits to have meaning. For e.g. Accounts ending in 999 are for totals, Accounts ending in 5 or 7 are clearing accounts, the first two digits represent the major type for the account such as fixed asset versus current asset and so on. Suggested is to use number for GL accounts i.e. main accounts as known in D365 for Finance and Operations.

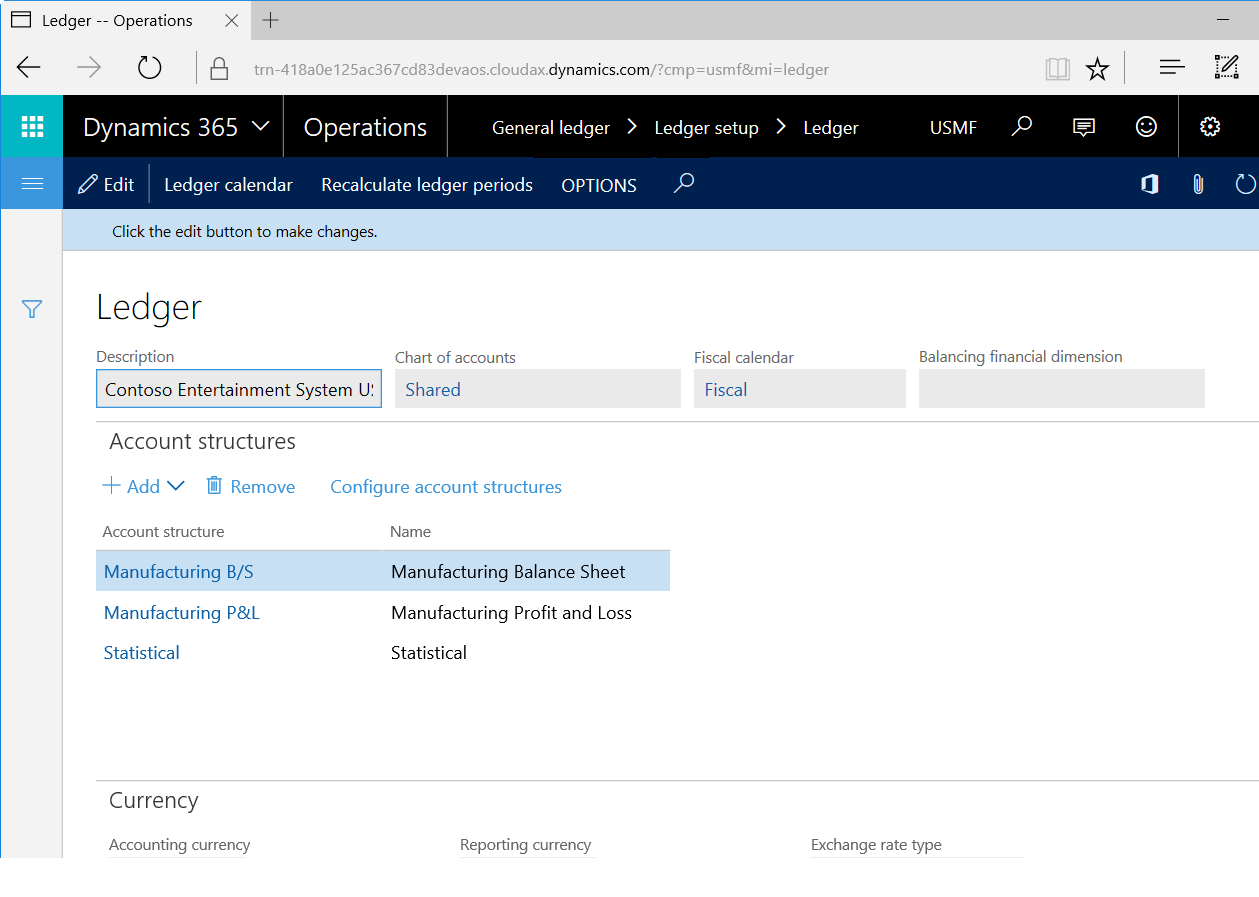

A chart of accounts can be shared and used by any legal entity in an organization. The chart of accounts that is used by a legal entity is defined on the Ledger page.

Here are some of the factors that you must consider when you plan the structure of the chart of accounts for your organization:

- The reporting requirements of the country or region where your organization is based

- The reporting requirements of your legal entity

- The degree of specification that is required, both for external organizations and for your organization

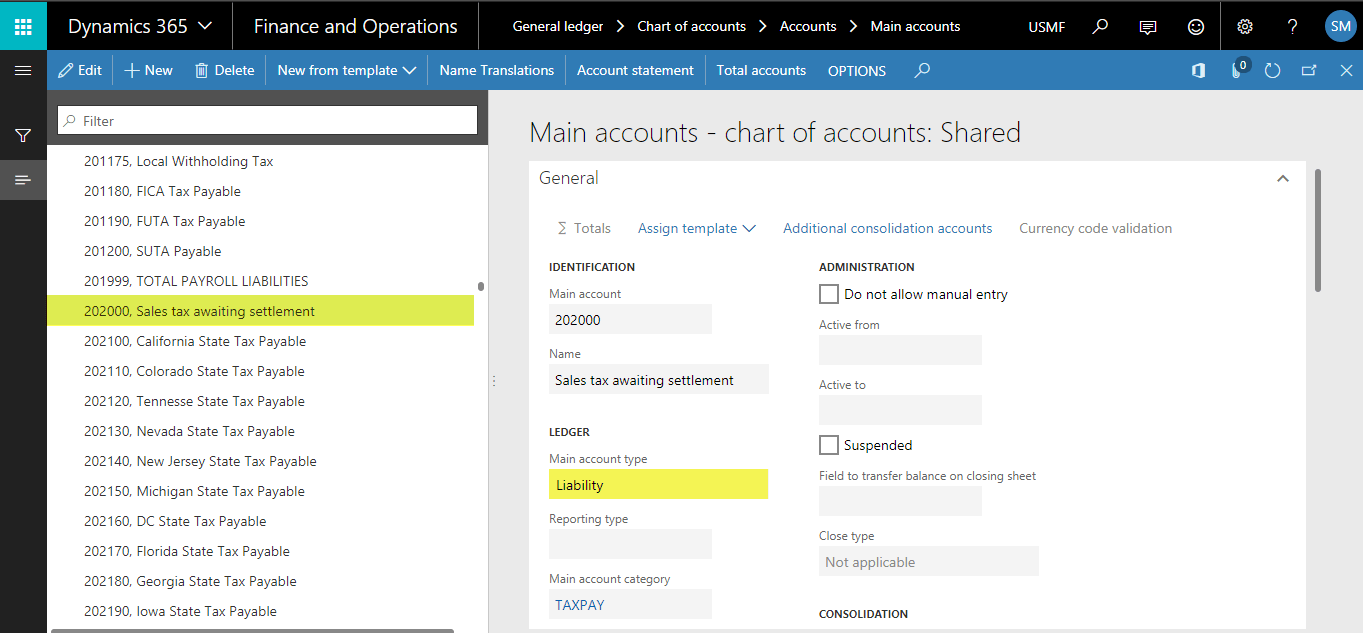

You create the chart of accounts on the Chart of accounts page. You can create main accounts from the Chart of accounts page or the Main accounts page. Your main accounts shouldn’t use any special characters that are used as delimiters for chart of accounts.

It’s a good idea to link the main accounts to main account categories, so that you can take advantage of the default financial reports without having to make any modifications. Therefore, you can more quickly and easily design and maintain reports.

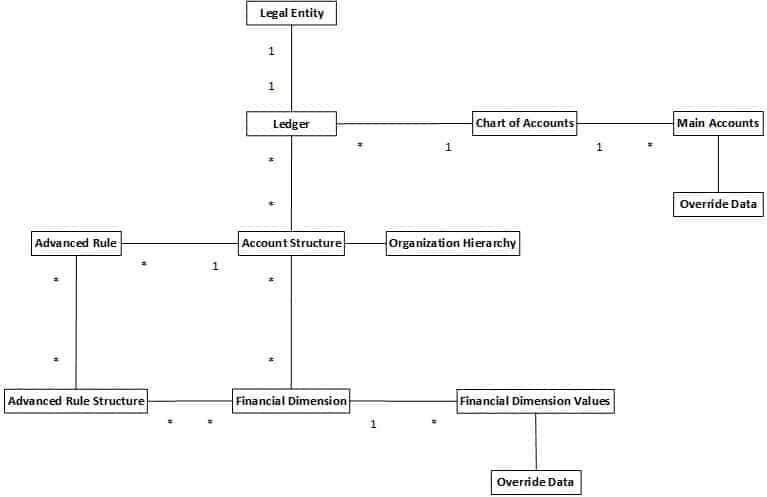

Legal Entity – A Company in D365 for Finance and Operations which is assigned a Company identifier.

Ledger – Established for each Legal Entity to dictate and maintain fiscal periods, determine account structure to use, select COA, set accounting and reporting currency, and other legal entity defaults.

Chart of Accounts – List of main accounts used to establish a financial framework.

Main Accounts – Ledger Accounts and the rules placed around each account which can be facilitated by using templates during the set up process. Main accounts can be used for Totaling and Sub-totaling as well as Financial Reporting, in addition to the more common Revenue, Expense, Asset, Liability and Equity types.

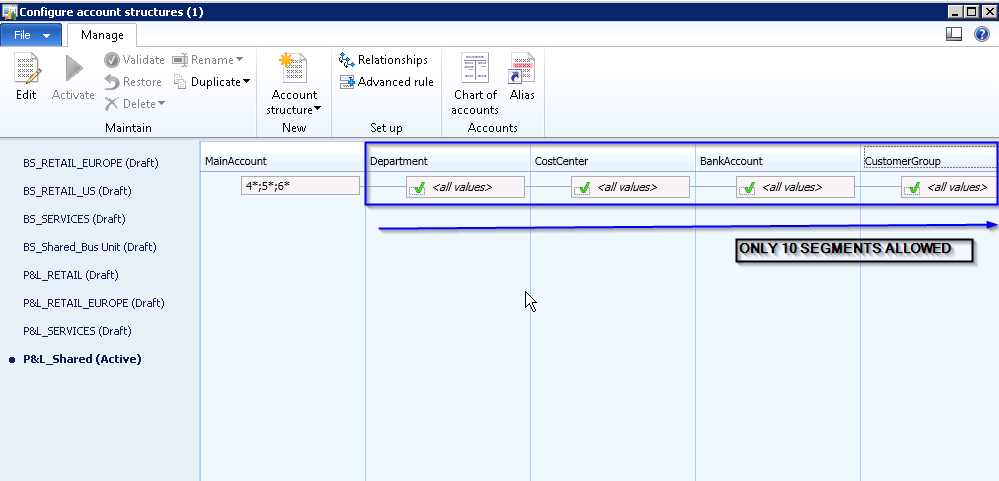

Account Structures – Rules that govern how the accounts and financial dimensions can be or must be used within that legal entity. Multiple Account structures can be in effect at the same time, so there is great flexibility in what can be done with these structures.

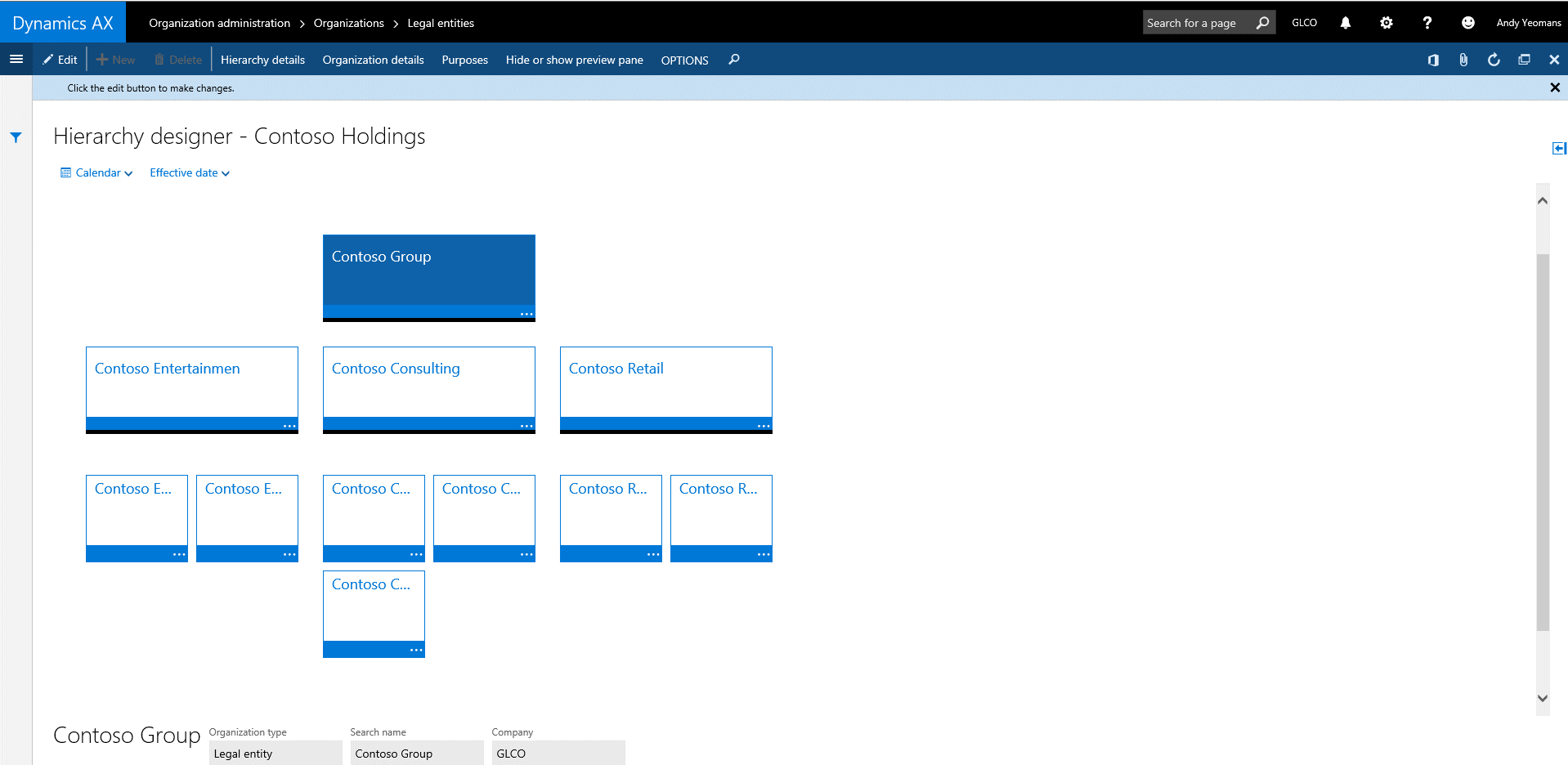

Organizational Hierarchy – Used to demonstrate relationships in the organization that exist for a purpose, such as financial, reporting, policies or centralized processes.

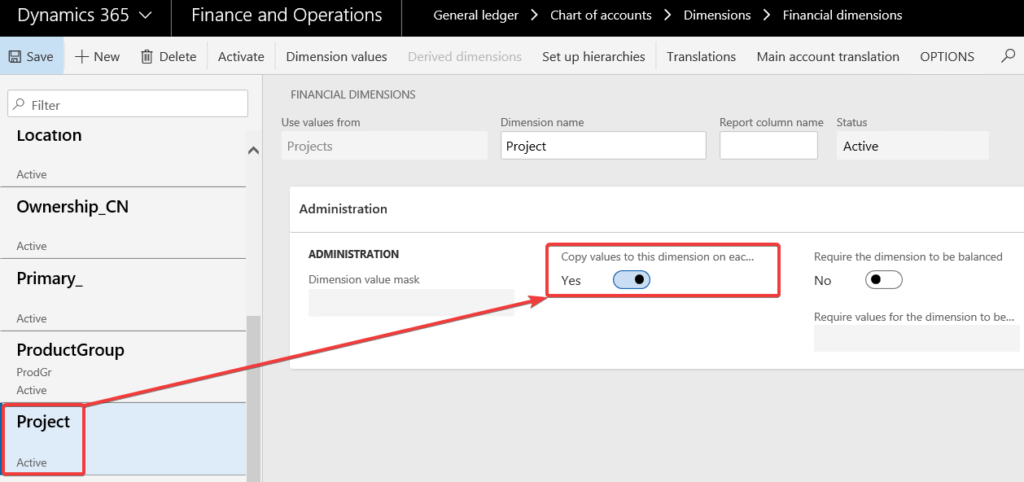

Financial Dimensions – segments to be used with the main account, as defined in the Account Structure, to create the accounting string to be attached to financial transactions in G/L for purposes of reporting and analysis.

Items to consider when deciding whether a separate Chart of Accounts is required for each Legal entity or if a Shared Chart of Accounts would be more beneficial:

Are the Legal Entities defined properly? Are the Legal Entities truly legal entities or could they be set up in some other way in the Chart of Accounts to achieve the required results?

If there are companies defined simply for purposes of internal reporting, organizational hierarchies might be a way to eliminate the need for some of the legal entities.

Consideration must also be given to transactions that will take place between and within the company organizations, to insure intra/intercompany transactions are properly captured.

It is recommended that financial dimensions are not used in place of creating Legal Entities, because financial dimensions cannot be used to satisfy all of the legal entity requirements (i.e. sales tax).

Is financial reporting of any legal entity dictated by a Statutory Chart of Accounts

Another option is to utilize financial dimensions and the fixed dimension function in D365 for Finance and Operations in lieu of having to set up a separate COA.

A COA cannot be shared across the partition, therefore, separate COA’s are required in this case.

Are all of the Legal Entities operating on different fiscal calendars and/or with varying currencies?

The fiscal calendar and currency set up for each legal entity is determined in the Ledger. The ledger also defines the COA for the legal entity. So legal entities can operate on different calendars and in different currency but share a COA.

Not all of the Main Accounts can be utilized by all of legal entities.

There are different requirements between Legal Entities in regards to the financial dimensions.

Each Entity has a Ledger and its own Account Structure (or structures), which is a set of rules that determine which dimensions are required and which ones are valid.

You create account structures on the Configure account structures page. Account structures define valid combinations. These combinations, together with main accounts, form a chart of accounts.

WhatsApp us

WhatsApp us

Leave A Comment