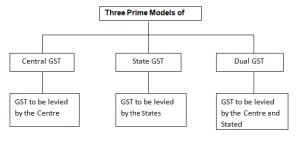

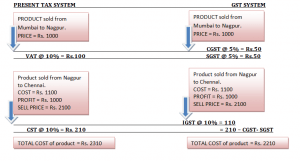

- GST replaces all indirect taxes levied on goods and services by the Centre and States, making for a single, easier taxation system

- GST represents not just a change in the tax regime, but a business transformation. Its introduction will necessitate a review and change of tax positions, the supply chain, enterprise resource planning (ERP) systems, business processes and accounting, among others. Industry has very limited time to implement the changes.

- After the introduction of GST, there is likely to be an increase in tax compliance obligations.

- Today, a service provider with operations, say in 20 states, can obtain a single centralized service tax registration, whereas under GST, separate registrations may have to be obtained in each of the 20 states. A service provider who would currently be filing only three service tax returns a year would have to file four or five returns per state per month, which amounts to about 100 returns per month, after the transition to GST

- With the implementation of GST, Central Excise and all such organizations will change their role from enforcement agency to facilitation agency.

- There are 60,000 Central Excise and Customs and state government officers who will be trained for the switch to GST, a tax system practiced in 160 countries

- GST will create transparency and credibility, the GST is expected to bring in numerous changes.

- A key intention of introducing the GST is to make India a single market and alleviate the multiple formalities involved in transit of goods between states through waybills, transit forms, entry forms, inspections at checkpoints, etc.

- It is estimated that due to these procedures, goods take longer to move between Delhi and Mumbai than between Mumbai and Europe. In line with this objective, the GST law should provide for seamless movement of goods without tough administrative requirements that will delay transit and add to costs.

- A further requirement to simplify ease of doing business as envisaged in the GST regime is to minimize registrations. Currently, the GST law requires all suppliers to register in each state where taxable supply of goods or services are made. Effectively, this means that suppliers in multiple states would have to obtain separate registrations, which is particularly difficult for companies with operations across India such as banking, telecom or airline companies. It is recommended that a single registration should be introduced to avoid such a cumbersome exercise.

WhatsApp us

WhatsApp us