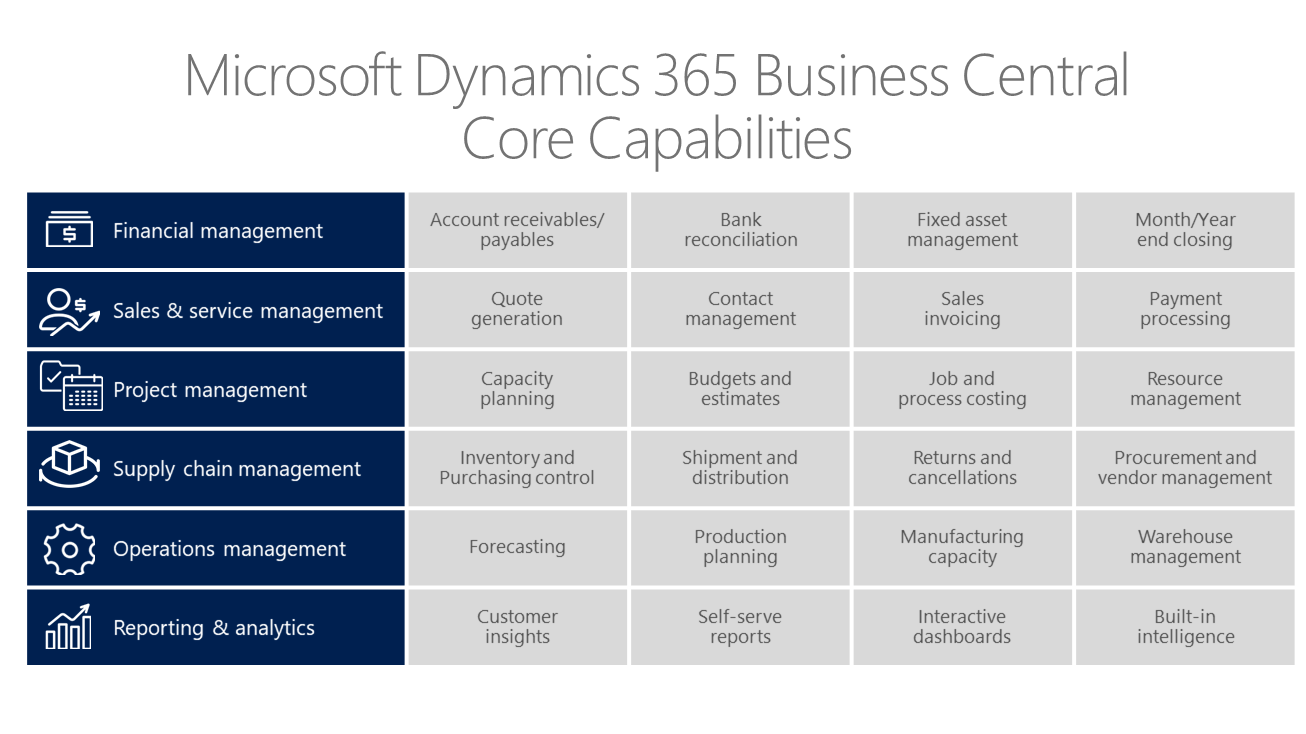

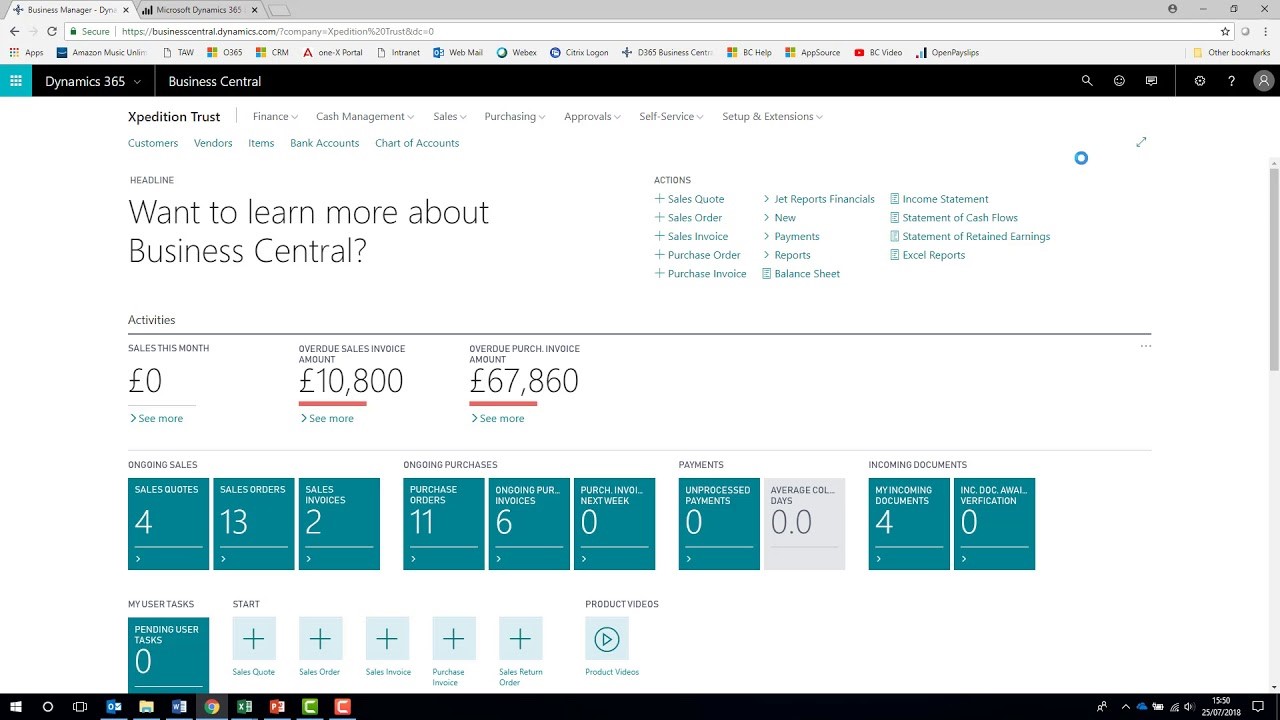

Dynamics 365 Business Central is an all-in-one business management solution that’s easy to use and adapt, helping you connect your business and make smarter decisions. Built on functionality within Microsoft Dynamics NAV and adaptable to extend business applications to other Microsoft Cloud Services such as Office 365, Microsoft Flow, Power BI and PowerApps; Microsoft Dynamics 365 Business Central Solution can grow as your business requirements change while taking advantage of the latest technology.

Microsoft Dynamics 365 Business Central Financial Management Capabilities are below:

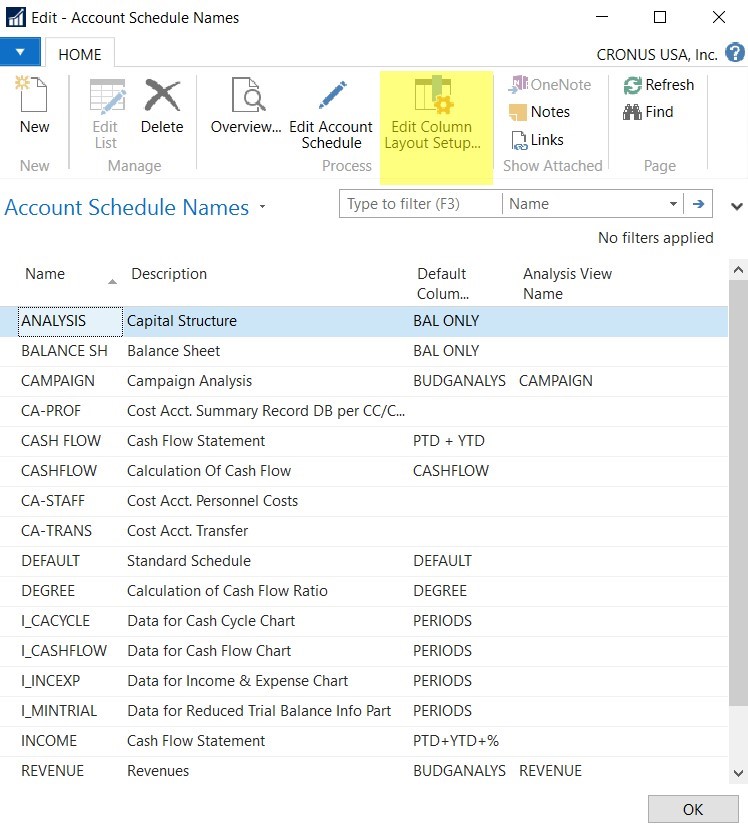

- Account Schedules

Account Schedules are used to get visibility into the financial chart of accounts data that resides inside Business Central in order to obtain reports like income statements, balance sheets, or cash flows. Account Schedules are accessed and used directly inside the Business Central application, so it relies on propriety code, layout, and formulas for creating reports.

Business Central delivers some sample account schedules, so you can use those templates or set up your own rows and columns. For example, you can create account schedules to calculate profit margins on dimensions like departments or customer groups. While you can create as many account schedule financial statements as you want, Account Schedules are confined to being inside Business Central unless, or until, manually exported to Excel using an export option.

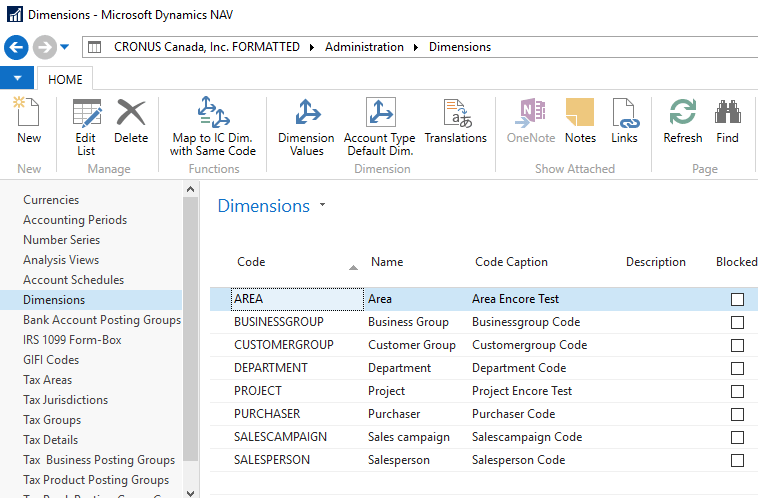

- Financial Dimensions

Dimensions are a ool to help you analyse your data in Microsoft Dynamics 365 Business Central. They allow categorization and grouping of data with similar characteristics such as Customers, Regions, Products, or Salespersons. For example, dimensions let you analyse your documents by department or project.

- Allocations

Cost allocations move costs and revenues between cost types, cost centers, and cost objects. You can define as many allocations as you need. Each allocation consists of:

- An allocation source.

- One or more allocation targets.

The allocation source establishes which costs must be allocated, and the allocation targets determine where the costs must be allocated. For example, an allocation source can be the costs for the Electricity and Heating cost type. You allocate all electricity and heating costs to three cost centers: Workshop, Production, and Sales. These cost centers are your allocation targets.

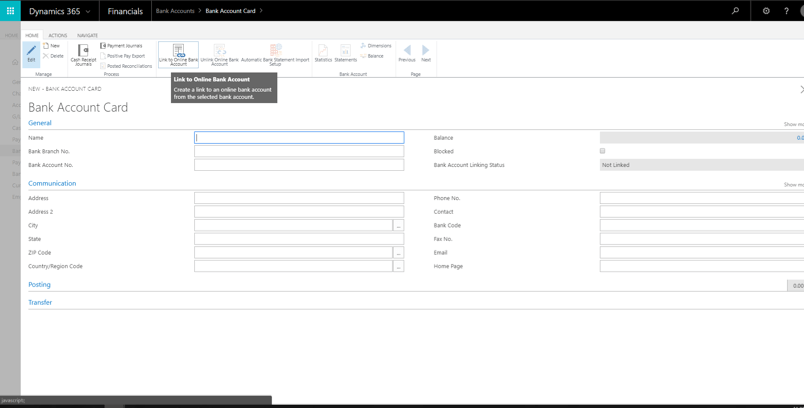

- Bank Account Management

At regular intervals, you must reconcile your bank ledger entries in Business Central with the related bank transactions in bank accounts at your bank, and then post the balance to your bank account. You can perform this task either as part of processing the payments represented on a bank statement in the Payment Reconciliation Journal.

Alternatively, you can perform the task separately from payment processing, on the Bank Acc. Reconciliation page where you match (reconcile) bank statement lines in the left-hand pane with your internal bank account ledger entries in the right-hand pane. In both pages, you can fill in the bank statement information by importing a file or feed and you can use automatic matching suggestions.

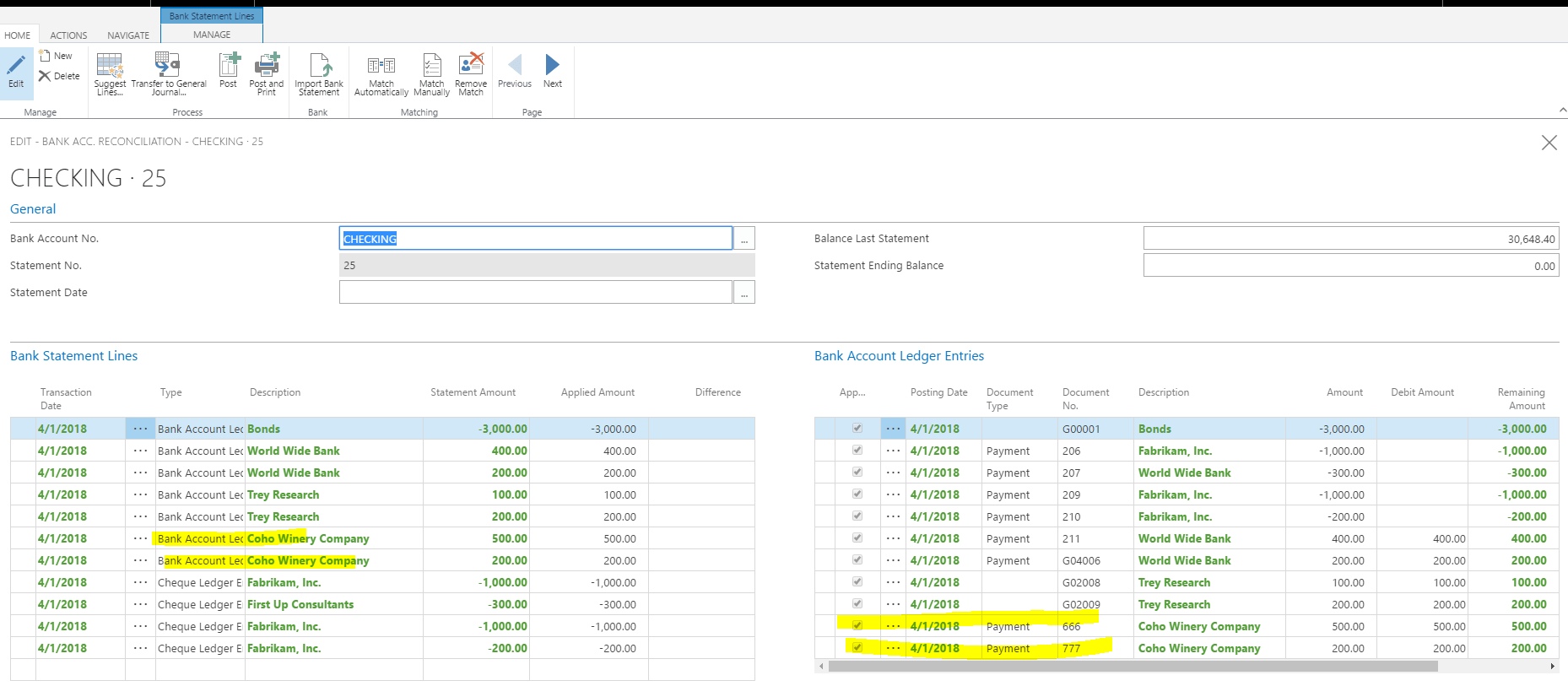

- Bank Account Reconciliation

The lines on the Bank Account Reconciliation page are divided into two panes. The Bank Statement Lines pane shows either imported bank transactions or ledger entries with outstanding payments. The Bank Account Ledger Entries pane shows the ledger entries in the bank account.

The activity of finding and applying entries to be reconciled is referred to as matching. You can choose to perform matching automatically by using the Match Automatically function. Alternatively, you can manually select lines in both panes to link each bank statement line to one or more related bank account ledger entries, and then use the Match Manually function. The Applied checkbox is selected on lines where entries match.

- Basic XBRL

XBRL, which stands for eXtensible Business Reporting Language, is an XML-based language for tagging financial data, and enabling businesses to efficiently and accurately process and share their data. The XBRL initiative enables global financial reporting by numerous ERP software companies and international accounting organizations. The goal of the initiative is to provide a standard for the uniform reporting of financial information for banks, investors, and government authorities.

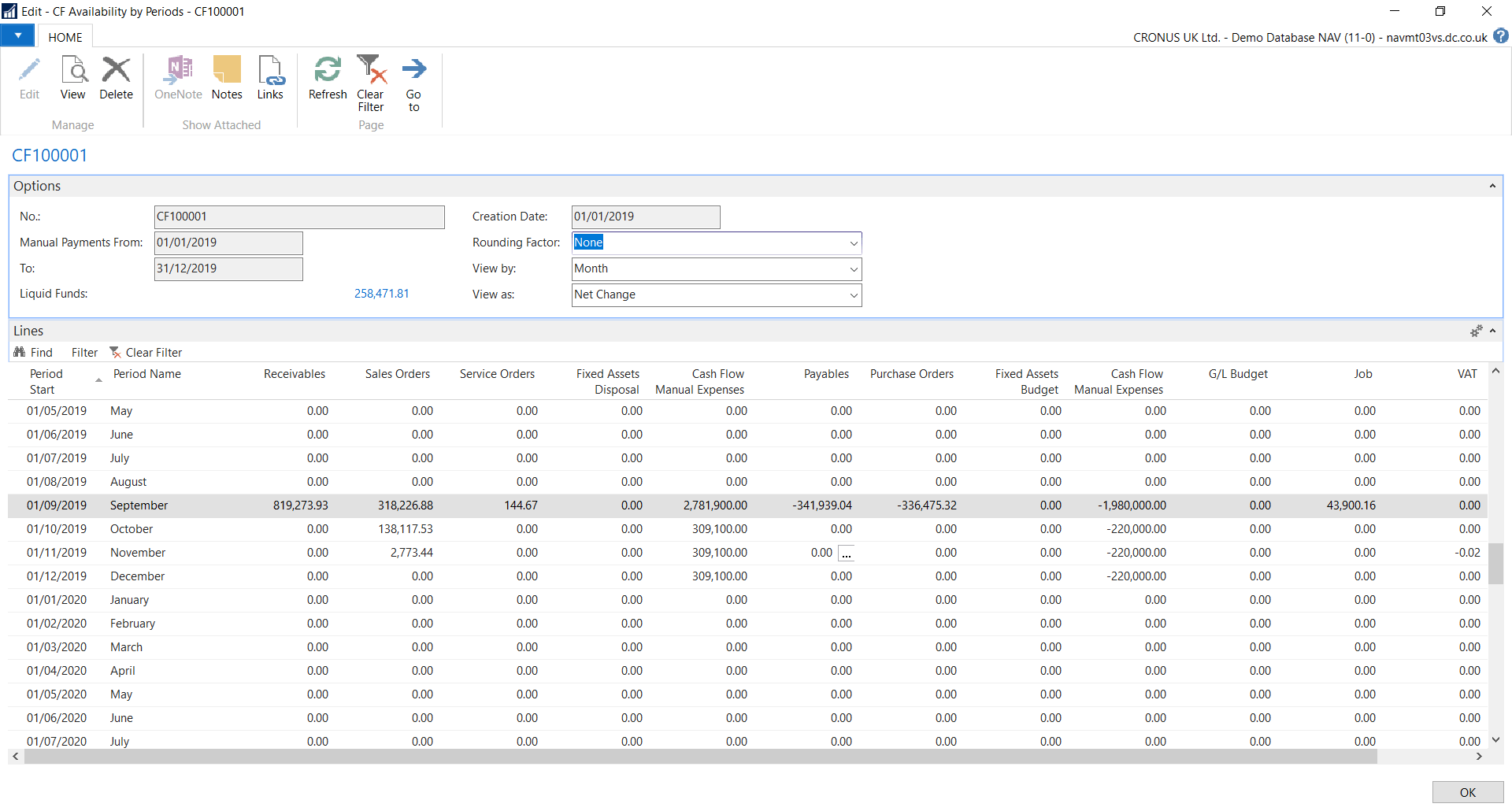

- Cash Flow Forecast

The cash flow in a business is a good indicator of its financial solvency and can reveal whether the business can meet its financial obligations. Microsoft Dynamics 365 Business Central provides tools that businesses can use to analyze their cash flow by analyzing historic data to make predictions for future periods. Cash Flow Forecast feature is an advanced reporting tool that can use Azure Machine Learning to model various scenarios and give you insights into what to expect.

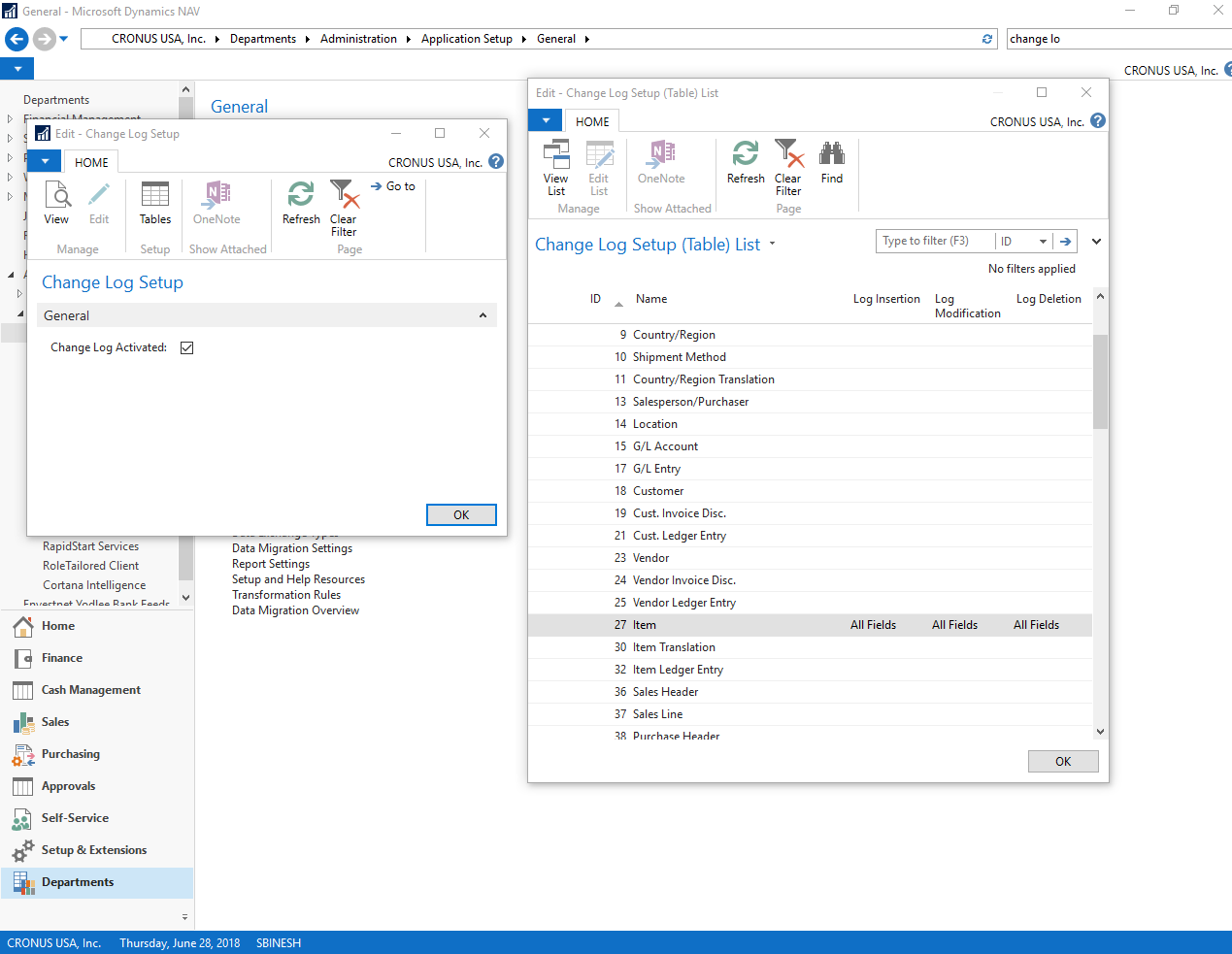

- Change Log

You can enable the change log in Business Central so you have a history of activities. The log is based on changes that are made to data in the tables that you track. On the Change Log Entries page, entries are chronologically ordered and show changes that are made to the fields on the specified tables. The change log collects all changes that are made to the table.

- Check Writing

You can issue electronic and manual checks in Business Central. Both methods use the payment journal to issue checks to vendors. You can also void checks and view check ledger entries.

You can pay a vendor with a computer checks by applying the payment to the relevant vendor invoice, printing the check, and then posting the payment as paid. This results in positive vendor ledger entries, applied to negative bank ledger entries, and physical checks for processing in the bank.

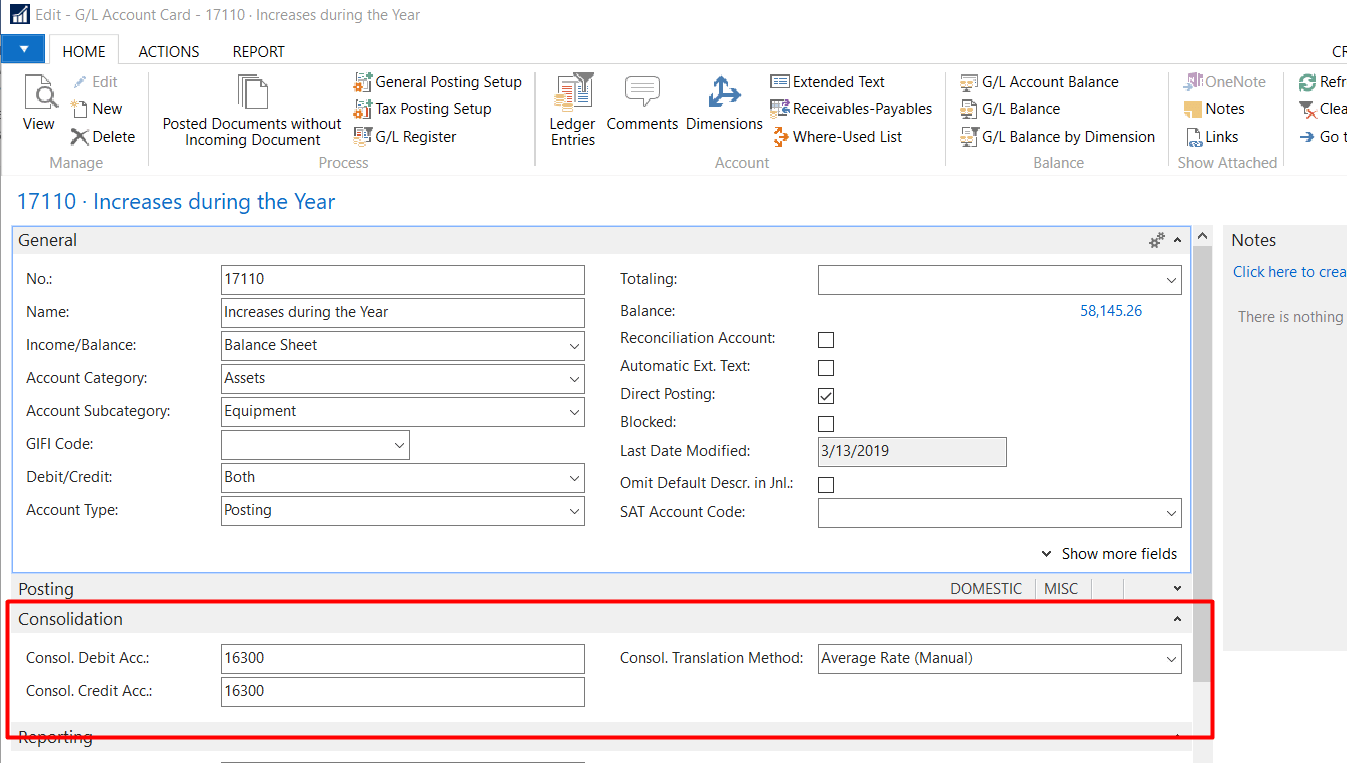

- Consolidation

If you have more than one company in Business Central, the Consolidated Trial Balance report on the Accountant Role Center can give you an overview of the financial health of your overall business.

The report combines general ledger entries from each of your companies in a new company that you create to contain the consolidated data. This company is typically referred to as the “consolidated company”. The consolidated company is just a container for the consolidated data, and does not have any live business data. The companies that you include in the consolidated company become Business Units in the report.

Consolidating financial data may especially be relevant in connection with intercompany processes.

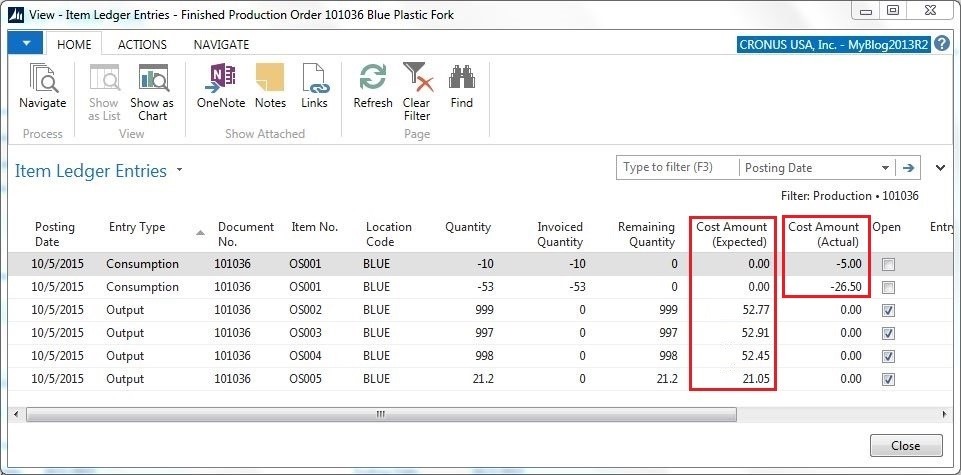

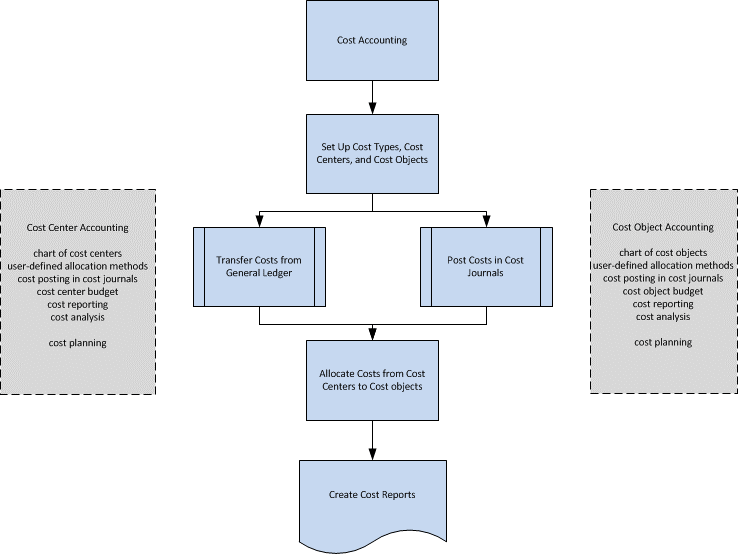

- Cost Accounting

Cost accounting can help you understand the costs of running a business. Cost accounting information is designed to analyze:

- What types of costs that you incur when you run a business?

- Where do the costs occur?

- Who bears the costs?

In cost accounting, you allocate actual and budgeted costs of operations, departments, products, and projects to analyze the profitability of your company.

Cost accounting has the following main components:

- Cost types, cost centers, and cost objects

- Cost entries and cost journals

- Cost allocations

- Cost budgets

- Cost reporting

- Deferrals

To recognize a revenue or an expense in a period other than the period in which the transaction was posted, you can use functionality to automatically defer revenues and expenses over a specified schedule.

To distribute revenues or expenses on the involved accounting periods, you set up a deferral template for the resource, item, or G/L account that the revenue or expense will be posted for. When you post the related sales or purchase document, the revenue or expense are deferred to the involved accounting periods, according to a deferral schedule that is governed by settings in the deferral template and the posting date.

- Electronic Payments/Direct Debits

With the electronic payments functionality, you can pay vendors using electronic payments rather than printing paper checks. Electronic payments are exported into a standard AEB N34.1 file format used by most banks. This file is then transmitted to your bank.

Also, with your customer’s consent, you can collect payments directly from the customer’s bank account according to the SEPA format.

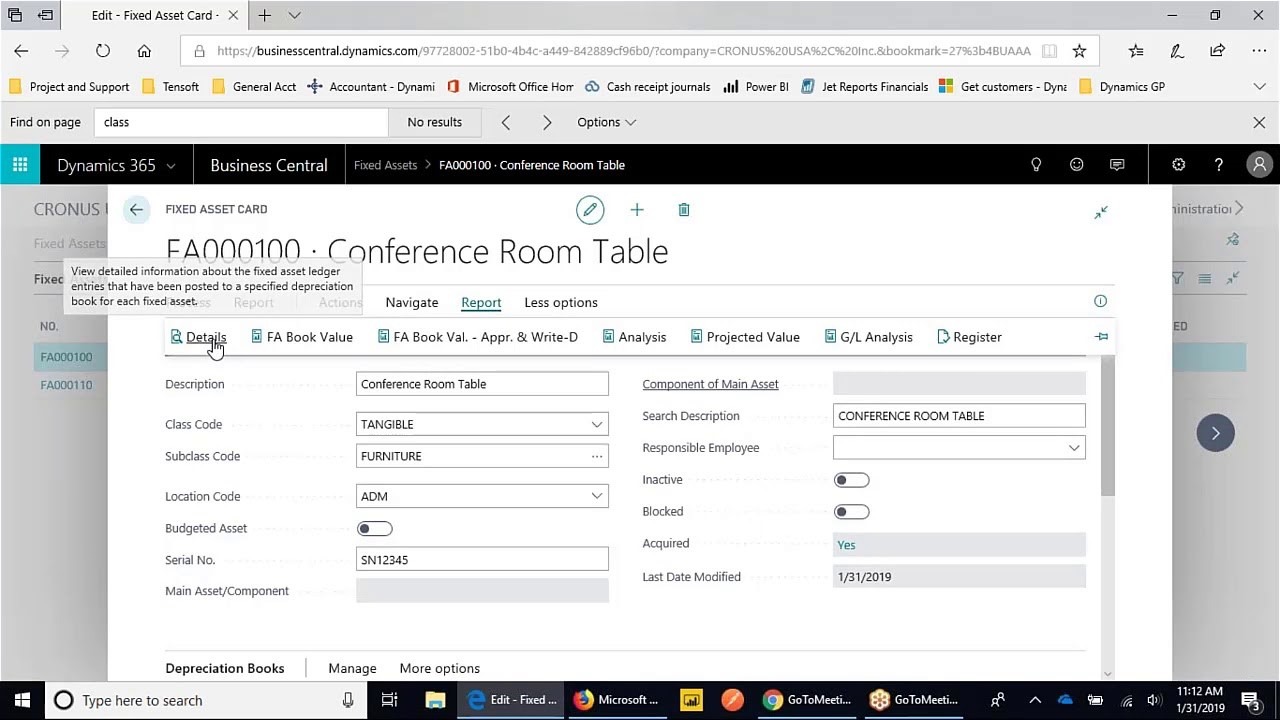

- Fixed Assets (basic)

The Fixed Assets functionality in Business Central provides an overview of your fixed assets and ensures correct periodic depreciation. It also enables you to keep track of your maintenance costs, manage insurance policies, post fixed asset transactions, and generate various reports and statistics.

For each fixed asset, you must set up a card containing information about the asset. You can set up buildings or production equipment as a main asset with a component list, and you can group them in various ways, such as by class, department, or location. Then you can begin to acquire, maintain, and sell the fixed assets. You can also set up budgeted assets. This makes it possible to include any anticipated acquisitions and sales in reports.

- General Ledger (basic)

The general ledger stores your financial data, and the chart of accounts shows the accounts that all general ledger entries are posted to. Business Central includes a standard chart of accounts that is ready to support your business.

The setup of the general ledger is at the core of financial processes because it defines how you post data.

The chart of accounts shows all general ledger accounts. From the chart of accounts, you can do things like:

- View reports that show general ledger entries and balances.

- Close your income statement.

- Open the G/L account card to add or change settings.

- See a list of posting groups that post to that account.

- View separate debit and credit balances for a single account

You can personalize the structure of your financial statements by mapping general ledger accounts to account categories.

- Inter-Company Postings

To send a transaction (such as a sales journal line) from one company and have the corresponding transaction (such as a purchase journal line) automatically created in the partner company, the companies involved must agree on a common chart of accounts and set of dimensions for use on intercompany transactions. The intercompany chart of accounts can be, for example, a simplified version of the parent company’s chart of accounts. Each company maps their full chart of accounts to the shared intercompany chart of accounts, and each company maps their dimensions to the intercompany dimensions.

- Multiple Currencies

As companies operate in increasingly more countries/regions, it becomes more important that they are able to review and report financial data in more than one currency.

Your general ledger is set up to use your local currency (LCY), but you can set it up to also use another currency with a current exchange rate assigned. By designating a second currency as a so-called additional reporting currency, Business Central will automatically record amounts in both LCY and this additional reporting currency on each G/L entry and other entries.

- Payment Management

Business Central allows you to manage bills of exchange, electronic payments, and vendor payments using the payment management function.

You can manage customer and vendor payments using payment slips. Payment slip has following components:

- Payment class – The type of payment that you want to perform, for example, bill of exchange, electronic payment, or check.

- Payment status – The progress level of a payment document. You must define a set of statuses for each payment class.

- Payment steps – A payment that is executed at a specified time. After a payment step is completed, you can move the payment document from one status to another.

- Payment address for vendors and customers – The address that is used for a vendor or a customer at the time of settlement. The payment address can be different from the vendor’s or customer’s default address.

- Reclassifications

At least once every fiscal year you must take a physical inventory, that is, count all the items on inventory, to see if the quantity registered in the database is the same as the actual physical quantity in the warehouses. When the actual physical quantity is known, it must be posted to the general ledger as a part of period-end valuation of inventory.

If you need to change attributes on item ledger entries as well as the quantities, you can use the item reclassification journal. Typical attributes to reclassify include serial/lot numbers, expiration dates, and dimensions.

- Responsibility Centers

Responsibility centers provide the ability to handle administrative centers. A responsibility center can be a cost center, a profit center, an investment center, or other company-defined administrative center. Examples of responsibility centers are a sales office, a purchasing department for several locations, and a plant planning office. Using this functionality, for example, companies can set up user-specific views of sales and purchase documents related exclusively to a particular responsibility center.

WhatsApp us

WhatsApp us

Leave A Comment